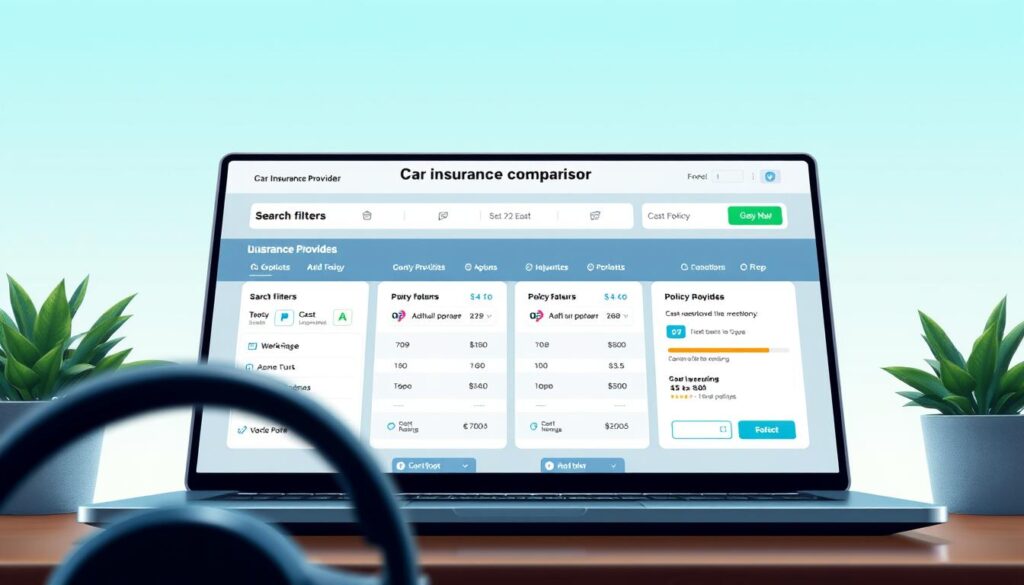

Compare Car Insurance Quotes Easily Online, Are you paying too much for your car insurance? Now, it’s easier to find affordable car insurance quotes online. With the right tools, comparing insurance can be simple. You can find the best car insurance for your needs.

Comparing car insurance quotes online can save you money. It helps you find the best coverage for your vehicle. Online tools let you compare rates from different providers. This makes it easy to find the most affordable option.

Key Takeaways

- Comparing car insurance quotes online can help you save money

- Insurance car comparison tools make it easy to find affordable car insurance quotes

- The best car insurance comparison websites provide a platform to compare rates from multiple providers

- Online tools can help you find the best coverage for your vehicle

- Comparing insurance car comparison rates can help you make an informed decision

- Affordable car insurance quotes are just a few clicks away with online comparison tools

Understanding Car Insurance Comparison Shopping

When looking for the right car insurance, comparing rates is key. A car insurance comparison tool lets drivers see rates from different providers. This helps find the best coverage at the lowest cost. An online car insurance comparison makes shopping easy and fast.

Several things affect insurance prices, like driving history and where you live. Knowing these can help drivers make smart choices. Some benefits of comparing include:

- Access to many coverage options

- Chances to save on premiums

- Customizing coverage to fit your needs

By comparing auto insurance rates, drivers can find the perfect match for their budget. An online car insurance comparison is a great tool for this. It lets you quickly see rates and options from various providers.

The main goal of comparing car insurance is to get good coverage without spending too much. With the right tools, drivers can make smart choices and get the best insurance for their needs.

Essential Information Needed for Insurance Car Comparison

When looking for cheap car insurance comparison, giving accurate and current info is key. A car insurance comparison website needs personal details, vehicle info, and driving history for quotes.

The info needed includes:

- Personal details: name, address, date of birth, and occupation

- Vehicle information: make, model, year, and mileage

- Driving history: accidents, tickets, and claims

Insurance companies use this info to offer a cheap car insurance comparison that fits you. A car insurance comparison website compares quotes from different providers. This lets you pick the best one.

Make sure your info is correct. Wrong data can cause problems with your insurance. Use a trusted car insurance comparison website and accurate info to find the best cheap car insurance comparison for you. BUtterfly

| Information Needed | Description |

|---|---|

| Personal Details | Name, address, date of birth, and occupation |

| Vehicle Information | Make, model, year, and mileage |

| Driving History | Accidents, tickets, and claims |

How Online Car Insurance Comparison Tools Work

Looking for the best car insurance quote? It’s key to know how online tools work. They use complex algorithms to get quotes from many insurance providers. This lets users compare rates and find the best fit for them.

The Technology Behind Quote Generators

The tech behind quote generators is advanced software. It analyzes data from many insurance companies. It considers things like driving history, vehicle type, and location to give accurate quotes.

By using a top car insurance comparison site, users’ personal data is safe. They can trust they’re getting the most accurate quotes.

Real-Time Rate Calculations

Real-time rate calculations are vital for online car insurance tools. They show the latest rates from different insurance providers. This helps users make smart choices about their insurance.

Using a trusted comparison site ensures users get the best rates and coverage. This is crucial for their needs.

Top Features of Leading Car Insurance Comparison Websites

Leading websites make insurance car comparison easy and fast. They have a user-friendly design. This lets users quickly compare quotes from different providers.

Some key features of top car insurance comparison websites include:

- Comprehensive coverage options

- Accurate quote generation

- Additional tools and resources, such as insurance guides and FAQs

These features help users make smart choices. They can save time and money. And find the best insurance for their vehicle.

For instance, some top websites offer discounts and promotions. This makes finding affordable insurance easier. They also provide a secure place to compare quotes and buy policies.

In summary, leading car insurance comparison websites offer great features. They help users find the best insurance policy. By using these sites, users can compare quotes, save money, and get the right insurance for their vehicle.

| Website | Features | Discounts |

|---|---|---|

| Website A | Comprehensive coverage options, accurate quote generation | Multi-vehicle discount, good student discount |

| Website B | Additional tools and resources, user-friendly interface | Military discount, low-mileage discount |

Common Mistakes to Avoid When Comparing Auto Insurance

When looking for cheap car insurance, using a comparison tool is key. But, many people make errors that can cost them more. It’s important to know these mistakes to get the right coverage without overpaying.

One big mistake is only looking at the price. This can leave you without enough protection. Always check the policy details, like deductibles and limits. A comparison tool helps you find the best deal for your budget.

- Not providing accurate information about your vehicle or driving history

- Not considering all available discounts and promotions

- Not reviewing policy details carefully before purchasing

By avoiding these errors and using a comparison tool, you can get the best car insurance. This ensures you and your vehicle are well-protected.

Understanding Different Types of Coverage Options

When you’re looking for car insurance, it’s key to know the different coverage types. An online comparison can help you find the right mix for your needs. The main types are liability, collision, and comprehensive coverage.

Liability coverage is a must in many places. It covers damages to others or their property if you’re in an accident. Collision coverage helps pay for your car’s damage, no matter who’s at fault. Comprehensive coverage covers damage from theft, vandalism, or natural disasters.

Looking for cheap insurance? Here are some tips for choosing your coverage:

- Level of risk: If you’ve had accidents or live in disaster-prone areas, choose more coverage.

- Budget: Think about how much you can spend on premiums and deductibles.

- Vehicle value: If your car is new or valuable, consider more coverage.

Knowing about coverage options and your needs helps you choose wisely. An online comparison can lead you to the best rates and coverage for you.

Tips for Getting the Most Accurate Quote Comparisons

When you use a car insurance comparison website, it’s key to give accurate info. This means telling them about your car’s make, model, and year. Also, mention how many miles it has. And, don’t forget to list all drivers who will use the car. This info affects your insurance quote.

Knowing about discounts is also important. Many sites offer discounts for good grades, military service, or certain memberships. By learning about these discounts, you can find better deals and save on your insurance.

- Provide accurate vehicle information, including the vehicle’s make, model, and year

- Declare all drivers who will be operating the vehicle

- Understand discount eligibility and take advantage of any discounts you may be eligible for

By following these tips, you can get a more accurate car insurance quote comparison. This helps you make a smart choice when picking a policy.

How Often Should You Compare Car Insurance Rates

It’s key to compare car insurance rates often to get the best policy. You should check rates at least once a year. But, if your life changes, like moving or getting a new job, you might need to compare more.

When you look at your policy, think about these things:

- Changes in your driving habits or history

- Updates to your vehicle or its value

- Changes in your budget or financial situation

By comparing rates often, you can find the best coverage at a good price. Online tools can help you find the best car insurance for you.

Remember, comparing car insurance rates is a continuous task. Stay informed and up-to-date to get the most from your policy. With the right insurance, you can drive with confidence, knowing you’re protected.

Conclusion: Making Your Final Insurance Decision

Comparing car insurance quotes online is a smart way to get the best coverage at good prices. Top car insurance comparison sites let you see rates from many providers. This way, you can pick a policy that meets your needs and budget.

When choosing your insurance, think about the good and bad of each policy. Look at coverage limits, deductibles, discounts, and the total cost. The cheapest policy might not always be the best. You need to find a balance between cost and protection.

This article has given you the tools to find the right car insurance. Use the tips to explore your options and choose wisely. Pick the top car insurance comparison site that offers the best value for you.

Top-Rated Pet Insurance Plans to Protect Your Pets

FAQ

Why is it important to compare car insurance quotes?

Comparing car insurance quotes helps you find the best coverage at a good price. By looking at different quotes, you can save money. You also make sure you have the right protection for your needs.

What are the key factors that affect car insurance prices?

Several things affect car insurance prices. These include your driving history, the car you drive, your age and gender, where you live, and your credit score. Insurance companies use these to figure out how much to charge you.

What are the benefits of using an online car insurance comparison tool?

Online tools let you quickly compare quotes from many providers. They offer a wide range of coverage options. You can shop from home, which is convenient. Plus, they often have extra resources to help you decide.

What information do I need to provide when comparing car insurance quotes?

You’ll need to give personal info like your name, age, and contact details. You’ll also need to share about your vehicle, like the make and model. Your driving history, including any accidents, is also important.

How do online car insurance comparison tools work?

These tools use advanced algorithms and real-time data to get quotes from many providers. They have partnerships with many insurance companies. This gives you a full view of your options. They also protect your personal data.

What are some common mistakes to avoid when comparing car insurance quotes?

Don’t just look at price without checking coverage levels. Make sure to read policy details carefully. Always list all drivers on the policy. This ensures you get the right protection.

How often should I compare car insurance rates?

You should compare rates at least once a year. Or when a big life event happens, like getting married or moving. Regularly comparing can help you get the best deal.