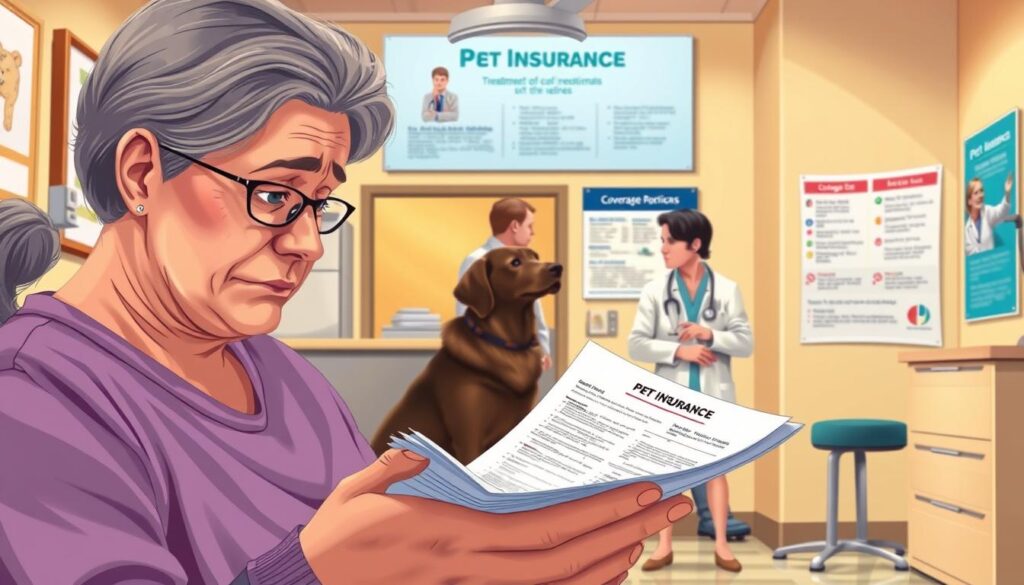

Protect Your Pet with Affordable Pet Health Insurance, Have you ever worried about what would happen if your pet got sick or hurt? Veterinary care can be very expensive. This leaves many pet owners facing a tough choice. Pet health insurance offers financial protection and peace of mind.

With affordable pet insurance, you can give your pet the best care without spending too much.

When thinking about pet health insurance, you might wonder if you can afford not to have it. The answer depends on understanding the benefits and options. In this article, we’ll explore pet health insurance. We’ll look at the different types of coverage, what affects the cost, and how to pick the right plan for your pet.

Key Takeaways

- Affordable pet insurance can provide financial protection and peace of mind for pet owners.

- Pet health insurance can help cover the cost of unexpected veterinary care.

- Understanding the different types of coverage is crucial in choosing the right plan for your pet.

- Factors such as age, breed, and health conditions can affect the cost of pet health insurance.

- Comparing pet insurance providers and plans can help you find the best option for your pet.

- Pet health insurance can be a valuable investment in your pet’s health and well-being.

Understanding Pet Health Insurance Basics

Pet health insurance is a key investment for pet owners. It helps protect against unexpected vet bills. Knowing what it covers and how it works is crucial. The pet insurance cost varies based on coverage, deductible, and reimbursement level.

Pet insurance can help with many vet costs, from routine visits to emergency surgeries. To choose the best pet insurance, compare different providers and policies. Look at coverage, premium costs, and customer service.

- Accident-only coverage: protects against unexpected accidents and injuries

- Comprehensive coverage: covers accidents, illnesses, and routine care

- Wellness plans: cover routine care like vaccinations and check-ups

Understanding pet health insurance basics helps you make a smart choice. By comparing options, you can find the best coverage for your pet. This includes considering the pet insurance cost and finding the best pet insurance provider.

The Real Cost of Veterinary Care Without Insurance

Veterinary care can be very expensive. Without pet insurance coverage, the costs can quickly add up. From routine check-ups to emergency surgeries, the bills can be staggering. To make informed decisions about their pet’s health, owners should compare pet insurance options to find the best fit for their needs and budget.

Some common veterinary procedures and their average costs include:

- Surgery to repair a torn ligament: $1,000 to $3,000

- Chemotherapy treatment: $2,000 to $5,000

- Emergency room visit: $500 to $1,000

These costs can be overwhelming. But with the rightpet insurance coverage, owners can reduce their financial burden. This lets them focus on their pet’s recovery.

By understanding the real cost of veterinary care without insurance, owners can make better choices. Taking the time to compare pet insurance options helps. This way, owners can provide the best care for their pets. It gives peace of mind and financial security.

Common Pet Health Insurance Coverage Options

Choosing the right pet insurance plans is crucial. It’s important to know the different coverage types. Each has its own benefits and drawbacks. To make a good choice, compare pet insurance quotes and think about your pet’s needs.

Some plans offer accident-only coverage. This helps with unexpected accidents or injuries. It’s cheaper than full coverage but might not cover ongoing health issues well.

Types of Coverage

- Accident-only coverage: covers unexpected accidents or injuries

- Comprehensive coverage: covers accidents, illnesses, and routine care

- Wellness plan add-ons: provides additional coverage for routine care, such as vaccinations and check-ups

When looking at pet insurance quotes, consider coverage, deductible, and costs. Reading reviews and checking the insurance provider’s reputation is also key. This helps ensure you’re getting good value for your money. By understanding coverage types and comparing plans, you can choose the best for your pet.

The right pet insurance plan depends on your pet’s needs and your budget. Research and compare quotes to find a plan that offers the right coverage and protection for your pet.

| Coverage Type | Description | Cost |

|---|---|---|

| Accident-only | Covers unexpected accidents or injuries | Varies |

| Comprehensive | Covers accidents, illnesses, and routine care | Varies |

| Wellness plan add-ons | Provides additional coverage for routine care | Varies |

Factors Affecting Pet Insurance Cost

Pet insurance costs can change based on your pet’s age, breed, and health. Understanding these factors is key to finding the right plan. Reviews of pet insurance can also offer insights into costs and coverage.

Several factors influence pet insurance costs. These include:

- Pet’s age and health

- Breed and size of the pet

- Location and cost of living

- Level of coverage and deductible

Reading pet insurance reviews helps you compare plans. This way, you can find one that meets your needs and budget. By considering these factors and reading reviews, you can make a well-informed choice.

Finding the right pet insurance plan requires research and reading reviews. It’s important to think about your pet’s specific needs and circumstances. By understanding what affects costs, you can make a smart choice and protect your pet.

Comparing Top Pet Health Insurance Providers

Choosing the right pet insurance plan is crucial. You need to compare different providers to find the best one for your pet. Look at coverage options, premium structures, and customer service ratings.

Top pet health insurance providers offer various plans. These include accident-only, comprehensive, and wellness plans. These plans help cover unexpected vet bills, giving you peace of mind.

To make a good choice, research and compare pet insurance plans. Check the premium structures, deductibles, and reimbursement rates. This way, you can find a plan that fits your budget and covers your pet’s needs.

Coverage Comparison

- Accident-only coverage: covers unexpected accidents and injuries

- Comprehensive coverage: covers accidents, illnesses, and wellness care

- Wellness plans: covers routine care, such as vaccinations and check-ups

Premium Structures

Premium structures differ among providers. Some offer monthly, quarterly, or annual payments. It’s important to compare plans and choose a payment option that works for you and your pet.

Customer Service Ratings

Customer service ratings are key when comparing pet insurance providers. Look for providers with high satisfaction ratings and quick claims processing.

By comparing top pet health insurance providers, you can make an informed choice. This ensures you pick the best plan for your pet’s needs.

| Provider | Coverage Options | Premium Structure | Customer Service Rating |

|---|---|---|---|

| Provider A | Accident-only, comprehensive | Monthly, quarterly, annual | 4.5/5 |

| Provider B | Comprehensive, wellness plans | Monthly, annual | 4.8/5 |

| Provider C | Accident-only, comprehensive, wellness plans | Monthly, quarterly, annual | 4.2/5 |

How to Choose the Right Pet Insurance Plan

Choosing the right pet insurance plan is important. Pet insurance coverage options vary a lot. It’s key to pick a plan that fits your pet’s needs. Start by looking at and comparing pet insurance quotes from different companies.

A good plan should cover accidents, illnesses, and routine care. Some plans also offer extra benefits like wellness programs or dental care. When you’re comparing, think about these things:

- Coverage options: What does the plan cover, and what are the limitations?

- Premium costs: How much will you pay each month, and are there any discounts available?

- Customer service: What kind of support does the provider offer, and how easy is it to file a claim?

By doing your research and comparing plans, you can find the best pet insurance coverage for your pet. Remember to also look at the cost of pet insurance quotes. The price can change based on your pet’s age, health, and breed.

Understanding Policy Terms and Conditions

Understanding pet health insurance terms is key. Many pet owners find the fine print confusing. It’s important to know what you’re getting into. Different plans offer different things, so read carefully.

Waiting periods are a big deal. They’re the time between buying the policy and when it starts covering your pet. These can range from a few days to months. Also, some plans don’t cover pre-existing conditions.

Waiting Periods

Waiting periods matter when picking a plan. Some plans have shorter waits, others longer. Think about this when choosing, as it affects when you can use the coverage.

Pre-existing Conditions

Pre-existing conditions can be tricky. Some plans don’t cover them, others offer limited coverage. It’s important to know how your pet’s conditions are handled by the provider.

Reimbursement Options

How you get reimbursed is also important. Some plans offer direct reimbursement, others require you to pay first and then claim back. Choose a plan that fits your budget and needs.

Understanding policy terms helps you choose the right plan for your pet. Always read the fine print and ask questions if you’re unsure.

Making the Most of Your Pet Insurance Coverage

To get the most out of your pet insurance, it’s key to know how to file claims well. Also, find a plan that fits your needs by reading reviews. This way, you ensure your pet gets the best care.

Here are some tips to help you make the most of your pet insurance coverage:

- Keep accurate records of your pet’s veterinary visits and expenses.

- Understand your policy’s terms and conditions, including any deductibles, co-pays, or limits.

- File claims promptly and provide all required documentation to avoid delays.

By following these tips and choosing a reputable pet insurance provider, you can ensure that you’re getting the best possible coverage for your pet. Always read pet insurance reviews and compare different plans to find the one that works best for you and your pet.

Maximizing your pet insurance benefits requires some effort, but it’s worth it. It ensures your pet receives the best care. By being informed and proactive, you can make the most of your pet insurance coverage and give your pet a long, healthy life.

| Pet Insurance Provider | Coverage Options | Premiums |

|---|---|---|

| Provider A | Accident-only, comprehensive | $50-$100/month |

| Provider B | Accident-only, comprehensive, wellness | $75-$150/month |

Common Misconceptions About Pet Health Insurance

Many pet owners think pet insurance is too pricey and not worth it. But, the truth is, vet bills can be very high without insurance. Pet insurance can help protect your wallet and give you peace of mind.

Some people believe all pet insurance plans are the same. They think it’s not important to compare pet insurance options. But, different plans have different coverage, deductibles, and costs. By comparing, you can find a plan that fits your budget and needs.

- Pet insurance only covers accidents, not illnesses

- Pet insurance is only for young pets, not older pets

- Pet insurance is too expensive and not worth the cost

Knowing the truth about pet health insurance helps pet owners make better choices. By comparing different options, you can decide if pet insurance is right for you and your pet.

Tips for Reducing Your Pet Insurance Premiums

As a pet owner, finding ways to lower your pet insurance costs is key. Look for options that can make your premiums more affordable. When picking a plan, think about how much coverage you need. Choose providers that offer flexible and cost-effective plans.

Some providers give discounts for households with more than one pet. Paying your premium yearly can also cut costs. Remember, choosing a higher deductible can lower your premiums, but make sure you can afford it if you need to make a claim.

Multi-pet Discounts

Many pet insurance providers offer discounts for households with multiple pets. These discounts can save you 5-10% on your premium. This is a big savings for families with many pets.

Annual Payment Options

Choosing to pay your premium yearly can also save you money. Yearly payments often come with discounts, saving you up to 5% on your premium.

Deductible Choices

Your deductible choice affects your premium costs. Higher deductibles mean lower premiums. But, make sure you can afford the deductible if you need to make a claim.

By considering these factors and looking at different plans, you can find a policy that fits your needs. This way, you get the right coverage for your pet without breaking the bank.

| Option | Potential Savings |

|---|---|

| Multi-pet Discounts | 5-10% off total premium |

| Annual Payment Options | Up to 5% off total premium |

| Deductible Choices | Varies depending on deductible amount |

Conclusion: Securing Your Pet’s Future with Health Insurance

Investing in pet health insurance is a smart move for any pet owner. It helps protect your pet from unexpected medical costs. This way, they can get the best care possible.

When looking for pet insurance, you’ll find many plans that fit your budget. Whether it’s for your dog, cat, or other pet, there’s something for everyone.

Having the right health insurance for your pet means they’re covered, no matter what. It gives you peace of mind and lets you focus on loving your pet. You won’t have to worry about expensive vet bills.

Don’t wait until it’s too late. Start looking into pet health insurance today. Your pet will be grateful, and you’ll know you’re doing the right thing for their health.

Discover Virat Kohli’s Staggering Net Worth

FAQ

What does pet health insurance cover?

Pet health insurance covers many medical costs. This includes routine check-ups and emergency treatments. It also covers surgeries. The specific coverage depends on the plan you choose.

How does pet insurance work?

Pet insurance works by you paying a monthly premium. The insurance then covers part of your pet’s medical costs. You pay the vet bills first and then claim the insurance for reimbursement.

What are the different types of pet insurance coverage?

There are three main types of pet insurance. Accident-only plans cover unexpected injuries. Comprehensive plans cover both accidents and illnesses. Wellness plans cover routine care like check-ups and vaccinations.

How much does pet insurance typically cost?

Pet insurance costs vary a lot. It depends on your pet’s age, breed, and where you live. On average, it costs between $30 to $70 a month for dogs and $15 to $40 for cats.

What factors affect the cost of pet insurance?

Several factors affect pet insurance costs. These include your pet’s age, breed, and health. The coverage and deductible you choose also matter. Where you live also plays a role. Older pets and certain breeds cost more. Plans with lower deductibles and more coverage are pricier.

How can I compare pet insurance providers?

To compare pet insurance providers, look at coverage options and premium structures. Check customer service ratings and reviews. Look at the types of plans, reimbursement rates, and any exclusions. Get quotes from different providers to find the best fit for your pet and budget.

What should I look for when choosing a pet insurance plan?

When choosing a plan, consider coverage options, premium costs, deductibles, and reimbursement rates. Look at policy terms and conditions, like waiting periods and exclusions. Find a plan that meets your pet’s needs and your budget.

What are the common misconceptions about pet health insurance?

Some people think pet insurance is too expensive or doesn’t cover enough. But it can be affordable and provide financial protection for unexpected medical emergencies or chronic conditions.

How can I reduce my pet insurance premiums?

To lower your premiums, choose a higher deductible or pay annually. Take advantage of discounts for multiple pets. Compare quotes from different providers to find the best rate for your needs.