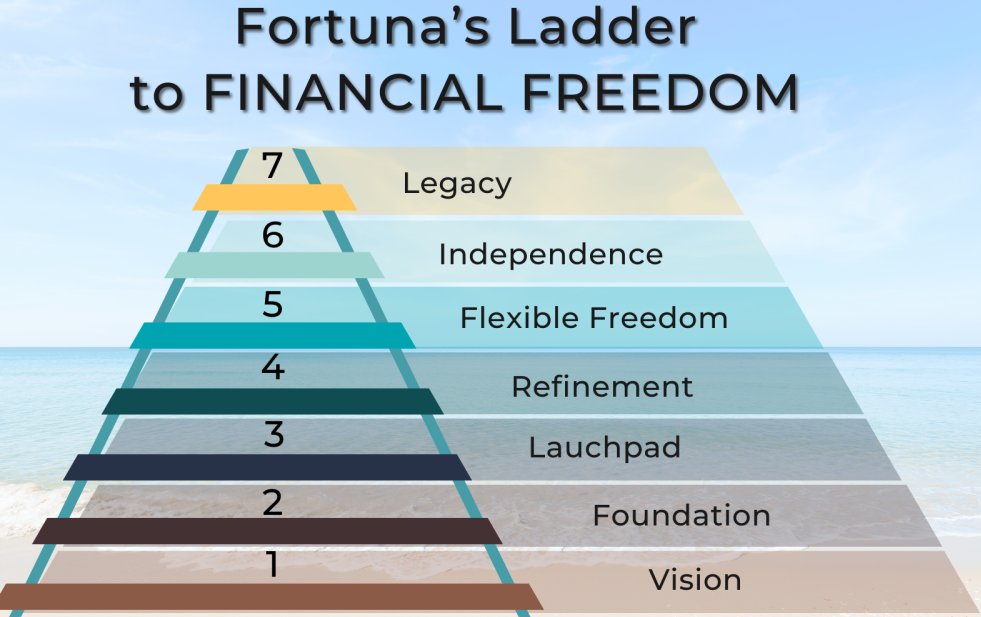

Achieving financial freedom is a process that requires careful planning, discipline, and consistent effort. Here are seven essential steps to help guide you toward financial independence:

1. Set Clear Financial Goals

- Define Your Vision: Financial freedom means different things to different people. Whether it’s retiring early, traveling the world, or living debt-free, clearly define what financial freedom looks like for you.

- Short-Term and Long-Term Goals: Set both short-term goals (e.g., paying off a credit card, saving for a vacation) and long-term goals (e.g., building retirement savings, purchasing a home).

2. Create a Detailed Budget

- Track Income and Expenses: Start by understanding your cash flow—how much you earn, how much you spend, and where the money goes. This can be done using budgeting apps or a simple spreadsheet.

- Cut Unnecessary Spending: Identify areas where you can reduce expenses (e.g., eating out less, canceling unused subscriptions). This will free up more money to put toward savings or investments.

3. Build an Emergency Fund

- Safety Net: An emergency fund should cover at least 3 to 6 months of living expenses. This cushion will protect you in case of unexpected events like job loss, medical emergencies, or urgent home repairs.

- Start Small, Build Gradually: Begin by setting aside small amounts until you build the fund. Automate savings to make it a regular habit.

4. Eliminate High-Interest Debt

- Pay Off Credit Cards: High-interest debt, like credit card balances, can be a major obstacle to financial freedom. Focus on paying off high-interest debts first, using methods like the debt snowball or debt avalanche.

- Avoid New Debt: As you pay off debts, avoid accumulating new ones. Consider using cash or debit cards instead of credit cards unless absolutely necessary.

5. Save and Invest Wisely

- Automate Your Savings: Set up automatic transfers to savings accounts or investment funds to make saving easier. Even small amounts can add up over time.

- Invest for Growth: Open retirement accounts such as a 401(k) or IRA. Invest in diversified assets like index funds, stocks, and bonds. The goal is to grow your wealth over time.

- Understand Compounding: The earlier you start investing, the more you can take advantage of compound interest. Even small contributions over time can lead to significant wealth growth.

6. Increase Your Income

- Side Hustles: Look for ways to supplement your income. Freelancing, part-time work, or starting a small business can boost your financial situation.

- Advance in Your Career: Seek career advancement opportunities through skill-building, networking, or education. A higher salary will increase your ability to save and invest.

- Leverage Passive Income: Invest in real estate, dividends, or other income-generating assets that earn money without requiring constant effort.

7. Maintain Financial Discipline

- Avoid Lifestyle Inflation: As your income increases, resist the temptation to increase your spending proportionally. Continue living below your means to maximize savings and investments.

- Review Your Finances Regularly: Reassess your budget, investments, and goals periodically to stay on track. Adjust strategies as needed to stay aligned with your long-term vision.

8. Focus on Financial Education

- Continuously educate yourself about personal finance, investing, and money management. Understanding how to grow and protect your wealth is essential to achieving financial independence.

- Read books, listen to podcasts, or attend workshops to enhance your financial knowledge and stay motivated. financial freedom financial freedom financial freedom

Final Thought:

Achieving financial freedom is a journey that requires patience and consistency. By setting clear goals, staying disciplined, and making smart financial decisions, you can gradually build wealth and achieve the freedom to live life on your terms.